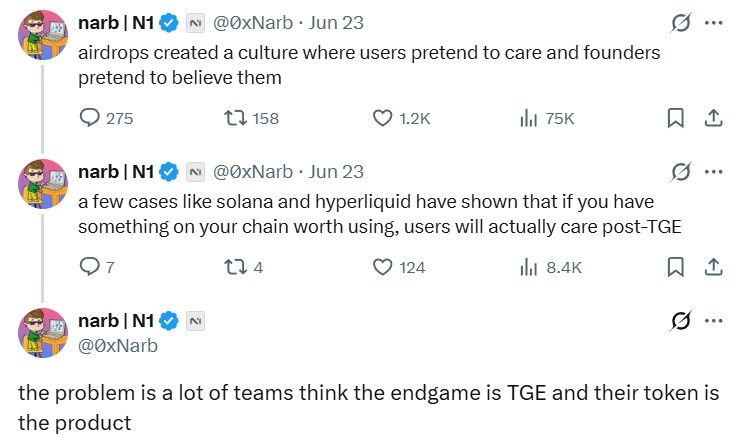

Token generation events (TGEs) are increasingly criticized as exit ramps for crypto founders, leaving behind blockchains with little real activity.

Projects often debut with thin circulating supply and inflated valuations, giving genuine supporters little chance to see sustainable returns. Industry sources argued that low floats and automated market makers (AMMs) help sustain prices temporarily, but once vesting unlocks begin, sell pressure typically overwhelms the market.

Some tokens spike at launch on hype and scarcity, but most slide steadily as supply enters circulation.

“It’s a never-ending cycle,” Brian Huang, co-founder of crypto management platform Glider, told Cointelegraph. “A new chain becomes irrelevant, talent leaves, and people left behind are stuck with a chain kept afloat by market makers and AMMs.”

The rising number of orphan chains post-TGE

In the past year, several founders have faced backlash for leaving their projects soon after token launches.

Jason Zhao, founder of Story Protocol, stepped away from his full-time role roughly six months after the token went live. Early reports suggested his exit coincided with a half-year vesting cliff, though Story denied this, noting that core contributors are subject to a one-year cliff within a four-year vesting schedule.

“In reality, the token launch is supposed to be the start of the project,” Huang said, questioning the intent behind such early departures.

Aptos founder Mo Shaikh also resigned on Dec. 19, more than two years after the Aptos token and mainnet launch. While his exit was not as immediate as Zhao’s, critics noted that it came soon after a major vesting milestone.